Copy Smarter, Not Harder: How to Lease the Perfect Commercial Copier

AI Overview: Smart Office Equipment Solutions

Commercial copier leasing has become the go-to strategy for businesses that want access to advanced printing technology without draining capital. With 8 out of 10 businesses financing their copiers, leasing transforms a large upfront purchase into a manageable, tax-deductible operational cost.

Your Guide to Smart Office Equipment Solutions

Commercial copier leasing offers a cost-effective way to access advanced printing technology without the hefty upfront investment of purchasing. With 8 out of 10 businesses financing their copiers, leasing is the preferred method for acquiring essential office equipment.

Quick Answer for Commercial Copier Leasing:

- Monthly costs: $50-$1,000 depending on features and volume

- Typical lease terms: 36-60 months

- What’s included: Equipment, maintenance, service, and supplies (except paper)

- Tax benefits: Lease payments are typically fully tax-deductible

- Flexibility: Easy upgrades and predictable monthly expenses

When it’s time to replace your office copier, you face a critical decision: spend thousands upfront for a new machine or find a smarter way to get the technology you need. Most businesses can’t afford to tie up $6,000 to $10,000 in capital for office equipment, which is where commercial copier leasing becomes a game-changer.

Leasing transforms a major capital expense into a manageable operational cost. It preserves working capital for revenue-generating activities while ensuring your team has reliable, modern equipment. However, not all lease agreements are created equal. Understanding the terms is key to avoiding hidden fees and restrictive clauses that can turn a good deal into a financial headache.

Why Lease a Commercial Copier? Weighing the Pros and Cons

When your office copier needs replacing, you’re faced with price tags that can easily hit $10,000 or more. Commercial copier leasing has become the go-to solution for a simple reason: it allows you to focus capital on growing your business rather than owning a depreciating asset. After 23 years in the business, we at Smart Technologies of Florida find this is the fundamental question for our clients.

Let’s break down how leasing compares to buying:

| Metric | Leasing a Copier | Buying a Copier |

|---|---|---|

| Upfront Cost | Low or none | High capital expenditure |

| Monthly Payments | Predictable, includes service and supplies | Variable (supplies, maintenance, repairs) |

| Maintenance | Typically included in lease agreement | Your responsibility, potentially costly |

| Technology Upgrades | Easy to upgrade at lease end or mid-term | Requires selling/trading old equipment, new purchase |

| Asset Ownership | No ownership (unless buyout option exercised) | Full ownership |

| Tax Treatment | Payments often fully deductible as operating expense | Depreciation over several years (Section 179 for first-year deduction) |

| Flexibility | High (scale up/down, upgrade) | Low (stuck with current tech) |

| Obsolescence Risk | Low (can upgrade to new models) | High (equipment can become outdated) |

| Cash Flow | Preserved | Impacted by large upfront cost |

The numbers tell a compelling story. Purchasing means taking on maintenance responsibility, technology obsolescence risk, and the full cost of ownership. In contrast, leasing offers scalability for business growth and keeps your options open. The most successful companies use their capital strategically. Learn more about the Advantages of Copier Leasing and how it fits into a modern business strategy.

The Primary Benefits of Leasing

Leasing offers several key advantages that make it a strategic choice for modern businesses.

- Lower Initial Outlay & Preserved Cash Flow: Instead of a large upfront payment, you may have little to no initial cost. This preserves cash for other business needs, like hiring or inventory, and establishes a predictable monthly expense for easier predictable budgeting.

- Included Maintenance and Service: Most leases bundle parts, labor, and toner into the monthly payment. When the copier needs service, one call gets it handled, often with next-business-day response times. This eliminates surprise repair bills and minimizes downtime. For more tips, see our Printer Maintenance 101 Tips.

- Easy Access to Technology Upgrades: Technology evolves quickly. Leasing prevents you from being stuck with outdated equipment. At the end of your term, you can easily upgrade to a new model with better speed, security, and efficiency.

- Flexibility for Changing Needs: As your business grows or changes, your printing needs may shift. Leasing agreements can often accommodate these changes, allowing you to scale your equipment up or down without the hassle of selling and buying.

- Tax-Deductible Operating Expenses: Lease payments typically qualify as fully deductible business expenses in the year they are paid, offering immediate tax benefits. Consult your accountant for specific guidance.

Potential Drawbacks to Consider

While leasing is often the best choice, it’s important to understand the potential downsides.

- Higher Total Cost Over Time: If you plan to keep a machine for many years without major repairs, the total of lease payments might exceed the purchase price.

- No Asset Ownership at the End: At the end of the lease, you don’t own the equipment. However, the resale value of a five-year-old copier is often minimal.

- Long-Term Contract Commitment: Leases typically run 36 to 60 months. Early termination can be costly, so you need to be confident in your long-term needs.

- Potential Usage Limitations: Leases include monthly copy allowances. Exceeding these limits results in overage charges, which can be expensive if your volume is unpredictable.

- Less Customization Control: Leased equipment usually comes in standard configurations, which may not suit businesses with highly specialized needs.

Decoding the Dollars: Understanding Commercial Copier Leasing Costs

When it comes to commercial copier leasing, the monthly payment is just the starting point. The true cost depends on usage, features, and the fine print of your agreement. With 8 out of 10 businesses choosing to finance their copiers, it’s clear that leasing makes financial sense when structured correctly. Understanding how these costs work is key to making an informed decision that aligns with your budget. For a comprehensive breakdown, see our guide on Copier or Printer Leasing Costs.

Key Factors Influencing Your Commercial Copier Leasing Rate

Your leasing rate is driven by several key factors, much like options on a new car.

- Color vs. Black and White: This is the biggest cost driver. A basic monochrome machine might lease for $50-$150 per month, while a color-capable model for moderate use typically runs $150-$350 monthly. Explore your options with our guide to Color Copier Machines in Florida.

- Speed (PPM): A machine’s pages per minute (PPM) directly impacts cost. A faster machine costs more, so it’s important to match the copier’s speed to your actual printing needs to avoid overpaying. For high-volume needs, see our insights on High-Speed Copiers for Business.

- Features and Functionality: Modern multifunction copiers can print, scan, fax, and email. Advanced features like stapling, hole-punching, larger paper trays, and improved security will increase the monthly lease payment.

- Lease Term Length: Longer terms (48-60 months) result in lower monthly payments but may have a higher total cost. Shorter terms (36 months) cost more per month but offer greater flexibility to upgrade sooner. A 48-month term is often a good balance for many businesses.

Understanding Volume Allowances and Overage Charges

Your lease agreement includes a monthly copy allowance, similar to a cell phone data plan. Exceeding this allowance triggers overage charges, which can quickly add up.

- Monthly Copy Allowances: It’s crucial to base your allowance on real-world usage, not a guess. Track your current print volume for a month or two before signing a lease.

- Overage Costs: Black and white overages typically cost 1-3 cents per page, while color overages can be 7-15 cents per page. Unplanned high-volume printing can become a significant unbudgeted expense.

- Accurate Volume Assessment: A proper assessment not only avoids overage fees but also ensures you aren’t paying for a higher allowance than you need. For more on managing these expenses, read about The Real Cost of Print.

Tax Implications: Leasing vs. Buying

The tax treatment of leasing versus buying is a significant factor for many businesses.

- Lease Payments as Operating Expenses: Your monthly lease payment is typically fully deductible as a business expense in the year you pay it, offering an immediate tax benefit.

- Section 179 Deduction: This IRS provision may allow you to deduct the full purchase price of qualifying purchased equipment in the first year. This does not apply to standard operating leases. Learn more about Section 179.

- Depreciation for Purchased Assets: Without Section 179, the cost of a purchased copier is depreciated over its useful life (usually 5-7 years), spreading the tax benefit out. We always recommend discussing your specific situation with a tax professional.

Your commercial copier leasing agreement is the roadmap for your partnership with a service provider. A lease is a contract for the use of an asset, and it’s crucial to understand what you’re agreeing to before signing. The most important advice we can give after 23 years in this business is to read the fine print. Pay close attention to Service Level Agreements (SLAs), which define response times and service guarantees. A quality provider should specify terms like next business day service in the contract. Our Copier Lease Agreement guide can help you understand what to look for.

Common Types of Commercial Copier Leasing Agreements

Choosing the right lease type can significantly impact your finances.

- Operating Lease (or True Lease): The most popular option. You’re essentially renting the equipment. It’s treated as an operating expense, keeping it off your balance sheet. At the end of the term, you return the copier or upgrade.

- Capital Lease ($1 Buyout Lease): This is more like a financing arrangement. The copier is an asset on your balance sheet, and you own it for $1 at the end of the term. Monthly payments are higher, but you build equity.

- Fair Market Value (FMV) Lease: This offers the lowest monthly payments. At the lease end, you can buy the copier for its current market value, return it, or renew the lease.

- Short-Term Rentals: Ideal for temporary needs like events or seasonal projects, rentals can range from a few days to a year. We offer Short-Term Copier Rental in Boca Raton for such needs.

What’s Typically Included (and What’s Not)

Most lease agreements are refreshingly comprehensive. Included is the full equipment use, complete maintenance and repair coverage (parts and labor), toner and supplies, and professional installation and staff training. This bundled approach simplifies budgeting and minimizes downtime. For care tips, see our Copy Machine Repair & Maintenance Tips.

What’s not included is straightforward: you’ll need to buy your own paper and staples.

Hidden Costs and Fees to Watch Out For

Be aware of potential hidden fees that can impact your budget.

- Delivery and Installation Fees: Can be $200-$500, though often included. Clarify this upfront.

- Insurance Requirements: You may need to carry specific coverage, or the lessor will add an insurance fee to your bill.

- Automatic Renewal Clauses: Many contracts automatically renew if you don’t provide notice within a specific window (e.g., 90 days before expiration). Mark this date on your calendar.

- Early Termination Penalties: Exiting a lease early can be expensive, often requiring you to pay the remaining balance.

- End-of-Lease Costs: Return shipping and handling can add $300-$500 to your final bill. Our guide on Hidden Photocopier Costs in USA details other potential surprises.

End-of-Lease Options: What Happens Next?

As your lease nears its end, you have several choices:

- Return the Equipment: The simplest option. Send it back and walk away.

- Renew Your Current Lease: Often available at a reduced rate.

- Upgrade to a New Model: A popular choice to get the latest technology. The remaining balance can often be rolled into the new lease, supporting your Technology Upgrade for Businesses strategy.

- Purchase the Copier: With an FMV lease, you pay the current market value. With a $1 buyout lease, it’s yours for a dollar.

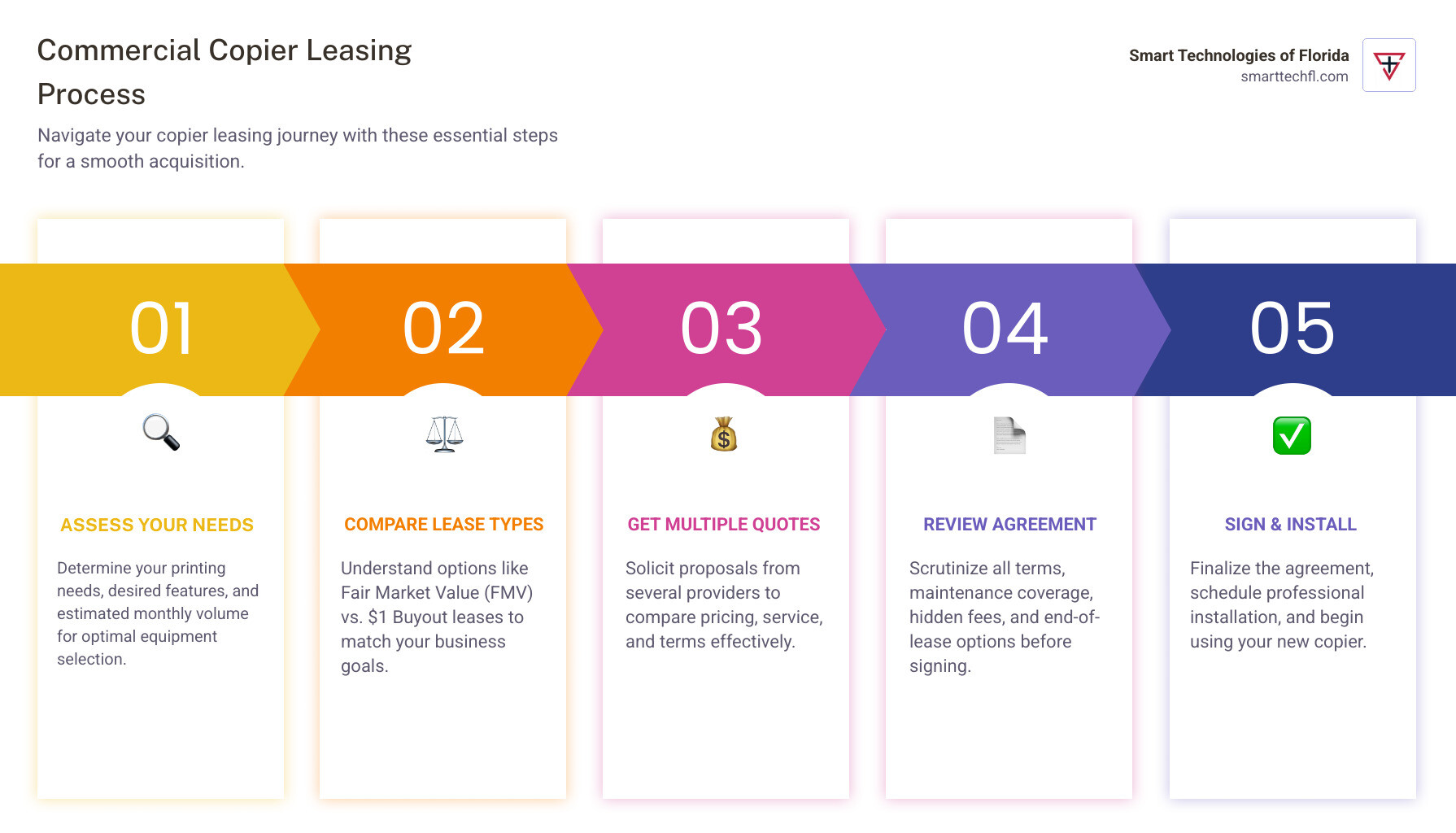

How to Secure the Best Copier Lease Deal

Securing the best commercial copier leasing deal isn’t just about the lowest price; it’s about finding the best value for your business’s needs. Being well-informed is your most powerful tool in this process. For a deeper dive, our guide on Mastering the Art of Leasing a Copier can help.

Even if your business credit history isn’t perfect, many providers offer programs that consider time in business or bank balances, sometimes with a larger deposit. Every business deserves access to quality equipment.

A Checklist for Comparing Providers

When comparing providers, look beyond the monthly payment. Use this checklist to ensure you’re getting a comprehensive and reliable solution.

- Total Cost: Confirm the all-inclusive monthly cost, including service and supplies.

- Volume Allowances: Ensure the included black & white and color print volumes match your expected usage.

- Lease Terms: Compare available terms (36, 48, 60 months) and how they align with your growth plans.

- Reputation and Reviews: Check online ratings for service and support.

- Service Guarantees: Get the service response time guarantee (e.g., next business day) in writing.

- Flexibility: Ask about options for mid-lease upgrades or changes in print volume.

- Industry Experience: A provider familiar with your industry may offer better recommendations.

- Overage Rates: Understand the penalties for exceeding monthly print volumes.

- End-of-Lease Options: Clarify your options to return, renew, upgrade, or purchase.

- Hidden Clauses: Ask specifically about early termination fees and automatic renewal clauses.

- Included Services: Confirm if installation, training, and removal of old equipment are included.

- References: Ask for references from other local businesses.

For more help choosing the right machine, see our 8 Tips for Choosing the Right Copier.

Negotiation Tips for a Better Deal

A little strategy can lead to a much more favorable commercial copier leasing agreement.

- Benchmark Rates: Research what similar copiers are leasing for to establish a reasonable baseline.

- Negotiate Total Cost: Focus on the entire cost of ownership over the lease term, not just the monthly payment.

- Consider a Separate Service Agreement: This can provide more transparency and negotiation power over service costs.

- Get Everything in Writing: Verbal promises are not binding. Ensure all fees, charges, and special arrangements are documented in the final contract.

- Get Multiple Quotes: Always contact at least three providers to compare offers and leverage competition.

- Time Your Negotiation: Sales teams often have quotas at the end of a quarter or year, which can lead to better deals.

- Be Realistic About Your Needs: Don’t pay for fancy features you won’t use. An accurate assessment of your needs prevents leasing an overpowered and overpriced machine.

Ready to find a partner who prioritizes your success? Request a personalized Copier Lease Quote from us today!

Frequently Asked Questions about Commercial Copier Leasing

We understand that diving into commercial copier leasing can bring up a lot of questions. It’s a big decision for your business, and we’re here to help clarify things! Here are some of the most common questions we hear from our clients, along with our straightforward answers to help you steer your options.

How much does it cost to lease a commercial copier?

That's often the first question on everyone's mind, and it's a great one! Just like buying a car, the cost to lease a commercial copier isn't a single, fixed number. It really depends on what you need. Think about factors like the copier's speed (how many pages per minute it can print), whether you need vibrant color documents or just crisp black and white, and all those extra features like scanning, faxing, or even stapling documents automatically. Your estimated monthly print volume also plays a huge role.

To give you a clearer picture, for businesses with lower print volumes (under 5,000 copies per month) that mostly need black and white, costs can start anywhere from $50 to $150 per month. If you're looking for a reliable color multifunction copier for moderate use (say, 5,000-10,000 copies monthly), you're typically looking at a range of $150 to $350 per month. For high-volume environments, where you're printing over 10,000 copies a month, those advanced machines can range from $300 to $1,000 per month. For most small to medium businesses seeking a dependable color multifunction copier, a sweet spot often falls between $150 and $500 monthly.

Can I upgrade my copier in the middle of a lease?

Good news! In many cases, yes, you absolutely can upgrade your copier during the lease period. This is one of the fantastic benefits of commercial copier leasing that gives you so much flexibility. Most reputable leasing companies, including Smart Technologies of Florida, offer what's called a "technology refresh" or an "upgrade clause" in their agreements.

What this means is that if your business grows, your needs change, or a new technology comes out, you're not stuck with outdated equipment. You can often roll the remaining balance of your current lease into a new agreement for a more advanced, efficient machine. This keeps your office productive and ensures you always have access to the latest and greatest technology without having to wait until the very end of your term. It’s all about empowering your business to stay agile!

Are maintenance and supplies included in a copier lease?

Absolutely, and this is truly one of the most significant advantages of commercial copier leasing! When you lease a copier, you're typically getting much more than just the machine itself. Your lease agreement will almost always be bundled with a comprehensive service and maintenance plan.

This means you can wave goodbye to unexpected repair bills! The plan usually covers all necessary maintenance, replacement parts, and the labor required for any repairs. Plus, essential supplies like toner cartridges are also included. You’ll usually receive one predictable monthly bill that takes care of everything, making budgeting a breeze. The only consumables you'll typically need to purchase separately are paper and, sometimes, staples. With an agreement like this, you get the peace of mind knowing your copier will stay operational with minimal downtime, often guaranteeing next business day service for repairs.

Conclusion: Empower Your Business with the Right Leasing Strategy

Choosing the right commercial copier leasing strategy is a critical business decision. As we’ve explored, leasing offers a compelling solution for accessing modern technology without a large capital outlay. It preserves cash flow, creates a predictable budget, provides access to easy upgrades, and includes the peace of mind of bundled maintenance and support, all while offering potential tax advantages.

While it’s important to be aware of long-term commitments and potential hidden fees, a strategic approach—understanding lease types, reading agreements carefully, and negotiating terms—ensures the benefits far outweigh the risks. Leasing is more than getting a machine; it’s about empowering your organization with efficiency, flexibility, and financial foresight.

Here at Smart Technologies of Florida, we’ve been a Business Change Agency for 23 years, specializing in helping companies steer these important choices. Our people-centric approach means we work with you to find the perfect technology solution, including a commercial copier leasing strategy that aligns with your unique goals. We want to help you copy smarter, not harder!

Ready to find the ideal solution for your office? Explore our Printers and Copiers solutions today, and let’s work together to empower your business.